The Tower of Deception

This is the story of our struggle with Tower Insurance. We now understand that

deception and denial is universal across many insurance companies in New Zealand and abroad.

We sincerely hope that this is not your story, and it never will be.

We are sharing our story to help you make informed decisions about retail insurance products

and providers.

Our Story

A burst water pipe in the ceiling caused serious damage to a large portion of our house.

The incident happened in November 2017, and the house is still uninhabitable.

Both the insurance company and two of their subcontractors (Asset Managers and

Absolute Building Solutions) acted well below acceptable standards in the reinstatement work,

and the house was left in a much worse condition than it was immediately after the flooding incident.

The subcontractors damaged a range of the house's contents as well.

There were three subcontractors involved: one to dry the house, and two for reinstatement work.

JAE, who were there to dry the place, were professional. The insurer instructed JAE to

leave before the house was completely dry: the house had a moisture content five times the

acceptable limit when JAE was asked to leave. The insurer stated that the builder will open

the walls to dry the house out, but after JAE left the insurer directed the builders to

plaster and paint the still-wet house. We discovered that the moisture level in the

house was still deemed high in some parts as late as May 2018 and JAE was brought

back in a second time to dry these areas. Meanwhile, there are cracks

and peeling in the new paint. Work carried out in the bathrooms was non-compliant with the Building Code

(holes in the wall; water-proofing applied incorrectly; improper Gib board used; Gib board fastened loosely)

but the insurer reiterated compliance and high-quality workmanship until an independent building

surveyor questioned this.

The subcontractors (Asset Managers and Absolute Building Solutions) have damaged a large

number of items: many of the internal doors have been chipped; walls have been incorrectly

plastered/painted; the bath was not protected during work and has been covered in paint

and plaster; the shower drain was filled with broken tiles and cement because it was

left open; many of our chattels have been abused (for instance, a toilet was

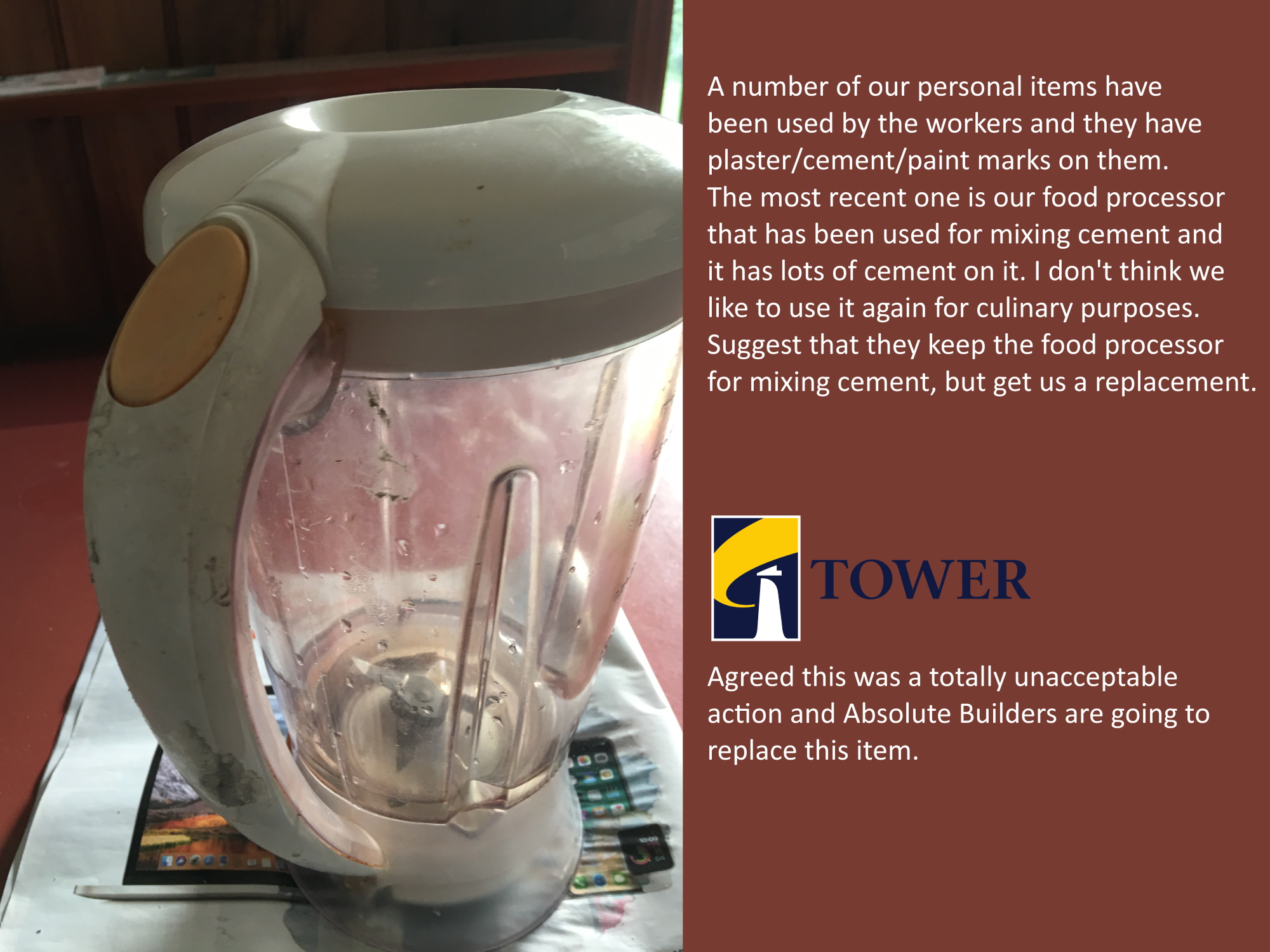

placed on one bed, and toilet mats were placed on the other bed; our food processor

was used to mix cement; a solid-wood bookshelf was used as a sawhorse and subsequently

damaged).

Tower, as one might expect, denies any liability. Their tales get stranger by the day!

The sad part is that the damages inflicted by Tower and its contractors can be fixed, it is just that Tower isn't willing

to do so.

Even though Tower had not fulfilled their policy obligations, Tower decided not to renew our house

insurance when it was up for renewal. The house is uninhabitable, and until it is made so, no

other insurance company will insure it.

Fighting an insurance company takes time. An awful amount of time. And Tower knows this, and

the timeline below shows it.

20 Nov 2017

A burst water pipe in the ceiling floods our house during the day.

22 Nov 2017

JAE, the drying company contracted by Tower, started the drying process in the morning.

They removed the carpet to help with the drying process

and discarded it with Tower's permission. (Months later Tower

will deny that the carpet was ever removed, and refuse to cover

the replacement cost.)

29 Nov 2017

The drying process was halted by Tower, stating that the drying was not effective

and their builders will remove the wall Gib boards to expedite the drying process.

When JAE left the house the moisture level readings in the house were five times higher

than the accepted threshold values – something we understood later in the

piece. Moisture levels will remain too high for another five months to come.

11 Dec 2017

Private plumbers start replacing old pipework. Tower was happy to have us do this work

before reinstatement commenced. The following day, the plumbers cut a few tiles in the

bathrooms, thereby damaging the water-proofing. This required water-proofing to be re-done

and the plumbers asked their insurance company to fix this.

18 Dec 2017

Asset Managers, Tower's building contractor, commence reinstatement work to correct

the original water damage.

They do not open any walls. No moisture measurements were taken before commencement of

this reinstatement work.

15 Jan 2018

Keith McDonald, Tower's assessor, visits the house to assess the damage in the bathrooms.

Asset Managers had damaged a number of doors during the reinstatement process, and

the plaster and paint work was substandard. In addition, they broke the key to the

main door, and then to have continued access to the house, they "broke" the garage

door mechanism so that it can be opened from outside, effectively leaving the house

unlocked. Keith is shown all of this, and he

assures to bring this up with Asset Managers.

25 Jan 2018

Asset Managers confirm that they have completed the work, but none

of the damage they caused has been fixed. Nor have they remedied the

substandard plaster and paint work.

8 Feb 2018

Asset Managers ask us to collect the house keys from their

office in East Tamaki.

When we go there, we are told that the keys are "securely stored"

on-site (i.e., at our house) with a combination lock.

Anton Tallot, the boss of Asset Managers, accompanies us to the

site to unlock the combination lock and retrieve the key.

We then understand that there was no lock, no combination, the

keys were left under the flower pot, and were nowhere to be

found. The following day Anton texts to say that he will pay for

the replacement of all locks of the house as they have lost the set of keys.

12 Feb 2018

Tower contracted Tony Gamble from Absolute Builders to fix the bathrooms

damaged by the plumbers. Tony starts the reinstatement work.

14 Feb 2018

The bathroom reinstatement work and water-proofing is seen

to be non-compliant. Besides, Tony had been using our personal

belongings during his work: he used our kitchen blender to mix

cement, and had been washing plaster and paint down the kitchen

sink. We write to Tower asking it to remedy these acts.

19 Feb 2018

Tower's Keith Macdonald and Ross Hailday along with their subcontractors

visit the house (without us, even though we wanted to be involved in the

inspections), and subsequently write to us:

"We inspected the waterproofing on Monday the 19th and the waterproofing

is to a high standard and correctly installed. The waterproofing is applied

correctly, with an access space allowed for entry under the spa bath."

11 Mar 2018

We engage Mr Gary Chalk, an independent building surveyor, to

provide independent expert advice on the remedial works by

Tower's two subcontractors.

27 Mar 2018

Tower's Keith Macdonald and Ross Hailday visit the property

with their building consultant to meet with Gary Chalk and us,

and resolve the issues.

A number of issues come to light from hereon. No moisture measurements

were taken before reinstatment work began. Gary points out the moisture

level in the house is still high – which explains why the new paint

is cracking and peeling off.

Water-proofing was applied poorly. The bath should have been taken out before

water-proofing, but it was not, and consequently was damaged by spills and excess water-proofing.

Gaping holes were left in the wall, or taped over and water-proofed.

The Gib boards were poorly screwed to the timber, and therefore not strong enough to hold

tiles.

3 May 2018

Tower brings JAE in to do moisture measurements, and some areas of the house

are found to have moisture levels above acceptable limits (after all these months

with a hot summer in between). Foil-backed Gib does not let the moisture dry easily unless

opened up – something Gary pointed out to us. Asset Managers did not open any walls,

and did not bother checking moisture levels either.

JAE bring heaters and dries the places for nearly a week.

1 Jun 2018

Tower is keen to bring their contractors back in to "fix", but given the

mess they created, we opt to go for a cash settlement so that we can hire

a reliable builder. Tower offers us $21,500.

We had two quotes and these

are around $80,000 for labour – with everything considered, the total

cost of getting the house back to how it was before the damages is around $149,000.

We point these out to Tower who update the scope of work, but not the cash sum

they were prepared to offer.

17 Oct 2018

Tower makes a revised offer after bringing in their builder for assessment and

backing down from their previously proposed scope.

Their revised offer is $55,700. We note that their buider's quote is unrealisitic

especially for reinstating the two bathrooms. In addition, none of the building material

costs nor the carpet reinstatement costs are included. When we point this out to their

solicitor, Tower chooses to ignore it. We reject the offer.

20 Jan 2019

We complain to the

Building Practioners Board that oversees the licensed building practioners scheme

about poor workmanship and non-compliance by Tony Gamble.

14 Jan 2019

Tower tells us that our insurance policy will not be renewed when it comes for renewal in March.

No other insurance company will insure it either since the house is not inhabitable.

23 Jan 2019

Tower pays $55,700 into our bank account, their solictor says that it was not "hush" money

and initiates a deadlock process which requires us to talk to IFSO if we want anything more.

7 Apr 2019

We laid a complaint with the Insurance and Financial Services Ombudsman (IFSO).

8 Aug 2019

Building Practioners Board arranges a hearing on Tony Gamble of Absolute Building Solutions.

Tony admits incorrect water-proofing and incorrect installtion of Gib walls.

The walls need to be stripped down, rebuilt, and new water-proofing applied.

The Board finds that these shortfalls are not serious enough to

impose a penalty on Tony.

Today

We are still waiting for closure ... we aren't counting months anymore.